Super

For The

Crypto Generation

Give your super the best chance to get to the moon

Don't Get Left Behind.

What is an SMSF, and how is it like decentralised super?

Answer: An SMSF is the blockchain of super funds. Just like crypto removes the middlemen from your money, an SMSF removes the big institutions from your retirement savings. It’s financial freedom at its core—you’re in complete control, deciding where and how your super grows. Think of it as decentralising your super, giving you the power to create your own financial future, just like crypto is rewriting the rules of currency.

What are the risks of investing in cryptocurrency through an SMSF without expert guidance?

Answer: Investing in crypto through your SMSF requires strict compliance with ATO regulations, including proper documentation, maintaining the fund’s sole purpose, and adhering to arm’s length rules. Mistakes can result in severe penalties, including loss of tax benefits or fund disqualification. With UDO SMSF, we ensure your investments are structured correctly and compliant, so you can focus on growing your portfolio without the stress of regulatory pitfalls.

How does UDO SMSF help me stay compliant with crypto investments?

Answer: We specialise in navigating the complex regulatory landscape of crypto SMSFs. From ensuring your investments meet ATO requirements to automating compliance reporting, we take care of every detail. Our tailored solutions include real-time monitoring, secure integrations with crypto exchanges, and expert guidance to keep your fund on the right side of the law.

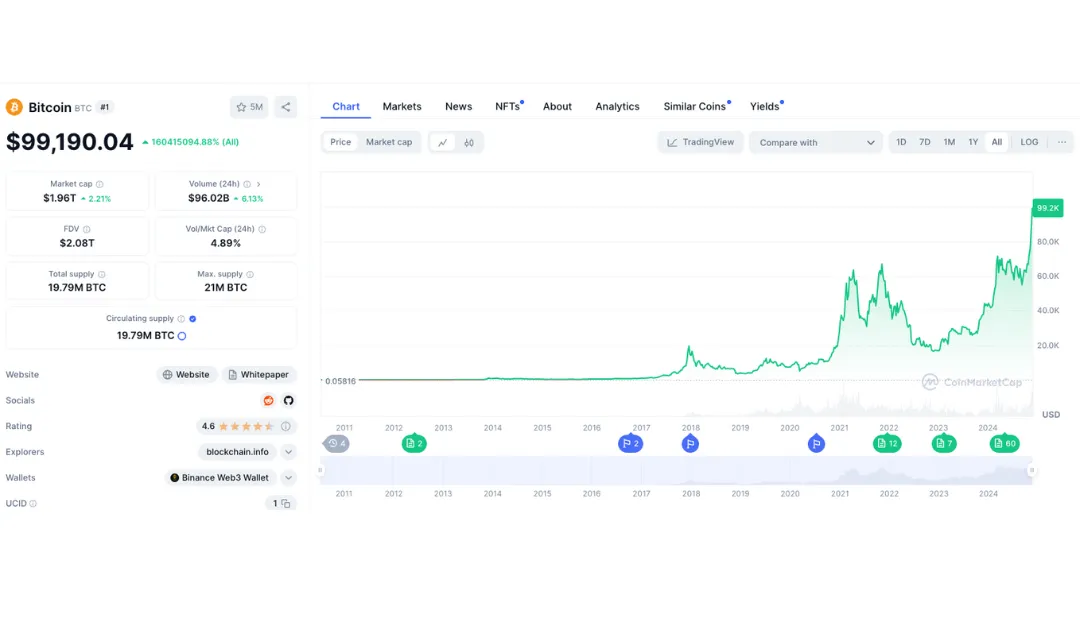

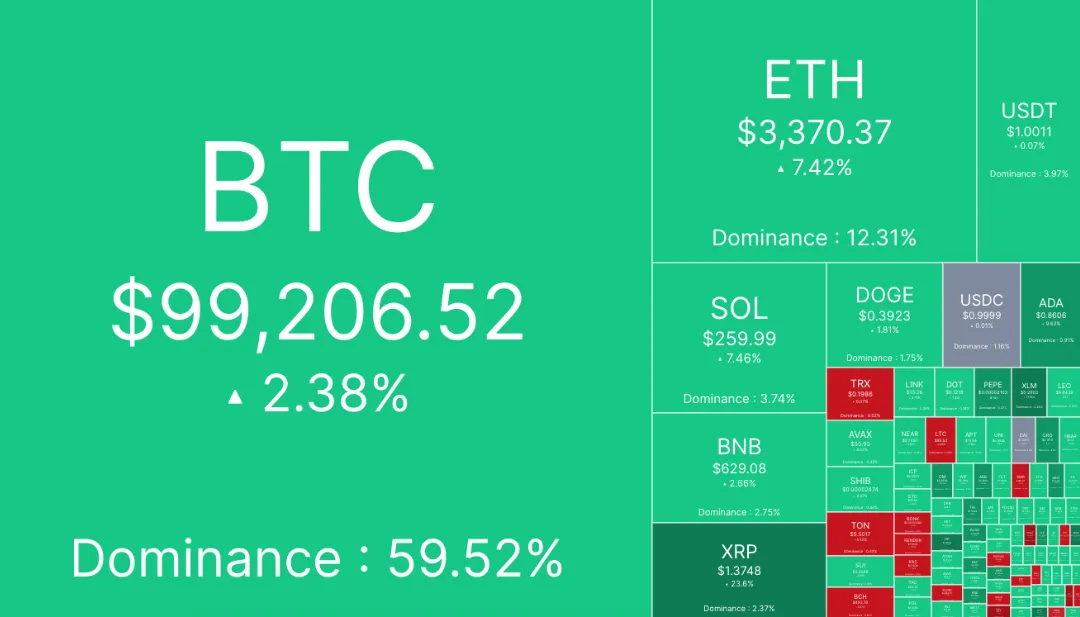

Why should I invest my super in cryptocurrency?

Answer: Cryptocurrency offers a unique opportunity to diversify your retirement portfolio with high-growth potential assets. As part of "The Crypto Generation," you'll have the chance to participate in the rapidly evolving digital economy while maintaining control over your investments. UDO SMSF empowers you with the tools and expertise to make confident, compliant crypto investments.

Why be part of the few that invest in crypto with super?

Answer: As a member of what we like to call "The Crypto Generation," you're at the forefront of a financial revolution. You'll gain access to cutting-edge investment opportunities, advanced tools for portfolio tracking, and the chance to build a more dynamic and future-proof retirement strategy. With UDO SMSF, you’ll have the confidence to invest in crypto while staying ahead of the curve.

Can I still invest in traditional assets with a crypto-focused SMSF?

Answer: Absolutely. While we specialise in cryptocurrency, UDO SMSF supports a wide range of investments, including property, shares, and other assets. Our flexible approach allows you to build a balanced and diversified portfolio that suits your financial goals.

Our Stats.

4000+

Funds Setup & Audited

25+

Years of SMSF Expertise

10+

Years of Crypto Experience

Simple Setup

Investing in crypto shouldn't be complicated. We make it easy.

Compliance Guarantee

Avoid the risks of getting it wrong and losing your bag.

Unlocked Potential

Super shouldn’t be stuck in yesterday’s investments.

Tax Optimisation

Keep more of what you earn with the right tax strategy for you.

it’s time to step into

the Crypto Generation

Crypto offers unprecedented opportunities for growth, diversification, and control.

Your SMSF is

Maximise You Super's Growth Potential

Access The Fastest Growing Asset Class

Take Control With Cutting Edge Solutions

From Decentralised Dreams

to Real Wealth

While others wait, you can get ahead of the curve.

Never worry about ATO regulations

Join a community of crypto investors

Be a part of the crypto generation

why we are a leader in the industry...

Crypto-Specific Expertise

Built by Crypto Investors, For Crypto Investors

We understand blockchain, exchanges, and crypto assets inside out

Integrated Risk Management

Leverage blockchain opportunities to build long-term security.

Seamless Integration

Tech-Driven Simplicity

Integrate with top exchanges and wallets effortlessly.

Eliminate errors with a seamless system designed for crypto investments.

Tailored integrations that adapt to your investment needs.

Real-time control over your investments to HODL or trade

Security First

Protect Your Crypto Wealth

Regulatory Compliance Guarantee with ASIC and the ATO

Integrated Risk Management

Storage Solutions

Tax Optimisation Solutions

Clear Pricing Right From The Start

Crypto Kickstart

SMSF Crypto Setup

Annual Compliance Check

Annual Tax Strategy

Free Access to 1 Exchange

No Fees for Centralised Transactions

Setup $1,900

$1,700 / year

Crypto Mastery

SMSF Crypto Setup

Annual Compliance Check

Annual Tax Strategy

Free Access to 3 Exchanges

No Fees for Decentralised Transactions

SMSF Property Setup

Setup Fee $1,900

$2,900 / year

Infinite Wallet

SMSF Crypto Setup

Annual Compliance Check

Tax Optimisation Strategies

Free Access to Any Exchange

1 - on - 1 Quarterly Strategy Session

Unrestricted DeFi Access

Unrestricted Leverage Support

Concierge Service

$Price On Application

work with australia's leading smsf crypto specialists

if you want to know more

book a time to speak to the team BELOW

Copyright © 2024 by Udo Super Services Pty Ltd.

All rights reserved.

Contact

General Information Warning & Disclaimer

All information contained on this website is provided as an information service only and, therefore, does not constitute, and should not be relied upon as, financial product advice. None of the information provided takes into account your personal objectives, financial situation, or needs, and you will need to make your own decision about how to proceed. Alternatively, for financial product advice that takes account of your particular objectives, financial situation, or needs, you should consider seeking financial advice from an Australian Financial Services licensee before making a financial decision.

Udo SMSF does not hold an Australian Financial Services Licence (AFSL) and we are not authorised representatives of an AFSL. We do not provide financial product advice or recommend any financial products either expressly or implied.

From time to time, Udo SMSF may produce information or content about specific financial products or services that enable access to specific financial products; however, we do not recommend, endorse, or confirm as suitable any financial product or service featured on the Udo SMSF website or social media assets. This condition specifically applies to any financial product where Udo SMSF provides services at a discounted or preferential fee due to the use of those products, services, or accounts. It’s not compulsory to utilise a specific account or service provider to be a client of Udo SMSF; however, the types of accounts, investments, and service providers you use for your SMSF will determine the fees your SMSF is charged.

Where Udo SMSF provides information in relation to a financial product or service supported by or integrated with Udo SMSF, the information is factual information only about the operation of the account or service and how data or reporting information is made available to us. Before making a decision on any financial product for your SMSF, you should obtain a Product Disclosure Statement (PDS) relating to that product and consider the PDS before making any decision. As financial product and solution providers are frequently making changes to their products and services, Udo SMSF cannot accept any responsibility for any outdated or inaccurate information provided on this website or via social media assets.

Udo SMSF is a Sydney based accounting firm looking after SMSF trustees from around Australia. Liability limited by a Scheme approved under Professional Standards Legislation.